Go down to the bottom of the page and control-click on the Download to Spreadsheet link and then "Save linked File or Download Linked File" to the computer.

From Excel, under File, release on Open, change Enable to All Files (from All Readable Documents) and then find the file called table.csv. Be sure that you have approximately 3 months worth of data.

Saving Your File Under File, release on Save As...

Change the name to

yourfirstnameyourstocksymbol.xls

(for example drsarahmsft.xls). Be sure there aren't any spaces!

Change the Format from CSV (Comma Delimited) to Excel 97-2004 Workbook (.xls) (at the top of the Format options), so that Excel can open it again later with our work.

Show this to me and get it approved.

Once you have approval, save your excel document.

Working With the Data in Excel to Create a Chart

Notice that the Date will be in the first column, Open price in the 2nd, High price in the 3rd, Low price in the fourth, Close price in the fifth, Volume in the sixth, and Adj. Close* in the seventh. You read about these for homework.

Follow Carefully: Click on A1 which has the word Date in it (NOT the gray A). Click on the Sort Ascending icon in Excel

(Under View, make sure that Toolbars/Standard is checked since the

Sort Ascending button is located on this.)

(Under View, make sure that Toolbars/Standard is checked since the

Sort Ascending button is located on this.)

Notice that now the data is now in increasing order by Date - when you clicked on the sort ascending button using the word Date, your entire chart was reordered. One must be very careful with this button in general!

We want to change one more thing before we create an Excel graph.

Click on B1

Under Insert, release on Columns.

Now there is an empty column between date and open.

Click on the gray box G (which is now where the Volume is located) so that the entire Volume column is highlighted.

Under Edit release on Cut

Click on the gray box B (the empty column)

Under Edit release on Paste

Notice that now our columns look like Date - Volume - Open - High -Low - Close - Empty Column - Adj. Close*

Click on the gray box H (where the Adj. Close* is located) and Under Edit, release on Delete.

Notice that now our columns look like Date - Volume - Open - High -Low - Close

Saving Your File Save your excel document again - under File, release on Save.

|

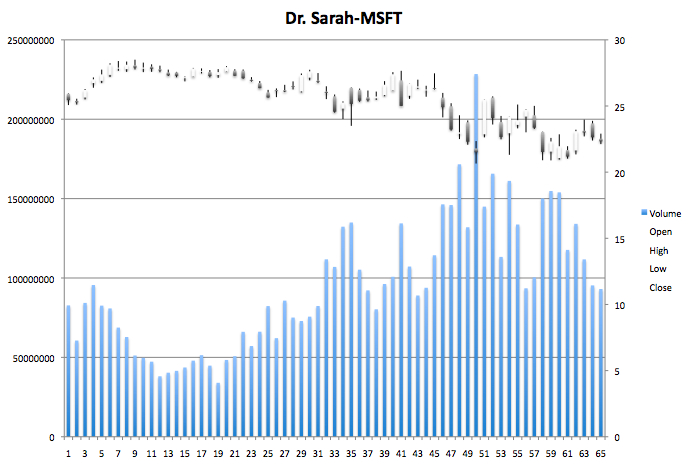

To create our Excel graph Click on the grey box B Click on the Command key on the keyboard that has an apple with a bite taken out of it and hold this key down. Continue to hold the key down as you click on C then D then E then F. Then columns B thru F will all be selected in that order. Under Insert, release on Chart On the green menu click on Stock Under Chart sub-type, click on the far right picture (Volume-Open-high-low) Click on the Toolbox Under Chart Options / Titles /Chart Title, enter in something like Dr. Sarah - MSFT Then close the Toolbox. |

|

Have me check your chart. To print a full page version of just the chart: