| How it Works

Lets say you hear a tip that McDonalds is coming out with a brand new product that is supposed to double their business. You think to yourself, "Darn, I wish I owned that company." Well you can. McDonalds, along with thousands of other companies, lets the public buy part of its company. It does this through selling shares. A share is simply a piece of paper that says you own part of a company. This part is usually extremely small, perhaps thousandths of a percent of the total company, but, hey, it is a beginning. You decide you want to buy part of McDonalds. You run home, and count up all of the money you have been saving, and find out you have 250 dollars. Well you are not going to be able to buy the whole company, but it is a start.

You've got the money, you know what stock you want to buy, now what? Do you go to the grocery store and ask for a dozen shares of McDonalds. Not exactly, but close. You don't go to a grocery store, but rather you call a broker. A brokerage house is your supermarket of stocks. You call up any broker and say, "Charles, I've got 250 dollars, and want to buy as much McDonalds as I can." You've got the money, you know what stock you want to buy, now what? Do you go to the grocery store and ask for a dozen shares of McDonalds. Not exactly, but close. You don't go to a grocery store, but rather you call a broker. A brokerage house is your supermarket of stocks. You call up any broker and say, "Charles, I've got 250 dollars, and want to buy as much McDonalds as I can."

Charles in return tells you, "Let's see, a share of McDonalds costs 20 dollars (Not the actual price), and I am going to charge you 50 dollars for my services, so you can buy 10 shares of McDonalds. " You then give Charles the money, and you get the stock. (They usually don't give you the paper stock certificates, but they transfer ownership over to you.) Voila, you have just bought stock in a company!

Sounds simple enough, right? Actually it is not if you look at it from the broker's point of view. When you told the broker you wanted those 10 shares of stocks, he did not magically buy them for you, or already own them. Rather, he sent a message to another person who is working down on the floor of the New York Stock Exchange (or any other stock exchange). He tells this person to buy these stocks for you. This person is called a "Floor Broker."

Now this person goes to the part of the Stock Exchange that is allotted to this particular stock. Here there are companies that specialize in this stock. This means that they will usually, if not always, buy and sell from people at the normal price. The floor broker then buys your ten shares from one of these people, reports his trade through the hundreds of computers on the floor, then reports to his colleagues back at the brokerage house that he bought the stock. The broker keeps a record that you own that stock, rather than sending you the actual paper stock certificates. If you ever want to sell them, your broker will sell them, deduct his commission, and then give you the money. Now this person goes to the part of the Stock Exchange that is allotted to this particular stock. Here there are companies that specialize in this stock. This means that they will usually, if not always, buy and sell from people at the normal price. The floor broker then buys your ten shares from one of these people, reports his trade through the hundreds of computers on the floor, then reports to his colleagues back at the brokerage house that he bought the stock. The broker keeps a record that you own that stock, rather than sending you the actual paper stock certificates. If you ever want to sell them, your broker will sell them, deduct his commission, and then give you the money.

Got all that? Well if you did not, here it is again using a simplified example. When you want a stock, you call a broker. The broker calls a person on the floor (usually an employee of the broker). This person runs to the space that is allotted to this stock. He then buys the amount of stock from the specialists, or companies, that are there to sell and buy on a regular basis. He then tells the firm he bought it, and then you have your stock.

|

Wall Street was becoming a major center of these transactions, and in 1792 twenty-four men signed an agreement that started the New York Stock Exchange (NYSE). They agreed to sell shares or parts of companies between themselves and charge people commissions, or fees, to buy and sell for them. They found a home at 40 Wall Street in New York City. As they grew they later moved into what is currently the New York Stock Exchange Building.

Wall Street was becoming a major center of these transactions, and in 1792 twenty-four men signed an agreement that started the New York Stock Exchange (NYSE). They agreed to sell shares or parts of companies between themselves and charge people commissions, or fees, to buy and sell for them. They found a home at 40 Wall Street in New York City. As they grew they later moved into what is currently the New York Stock Exchange Building.

The 1900s brought the Industrial Revolution, and along with it, a boom in Wall Street. Everybody wanted a piece of the action, and Wall Street grew. The New York Stock Exchange was not the only way to buy stocks at that time. Many stocks that were deemed not good enough for the NYSE, were traded outside on the curbs. This so called "curb trading," has now become the American Stock Exchange (AMEX).

The 1900s brought the Industrial Revolution, and along with it, a boom in Wall Street. Everybody wanted a piece of the action, and Wall Street grew. The New York Stock Exchange was not the only way to buy stocks at that time. Many stocks that were deemed not good enough for the NYSE, were traded outside on the curbs. This so called "curb trading," has now become the American Stock Exchange (AMEX).

You've got the money, you know what stock you want to buy, now what? Do you go to the grocery store and ask for a dozen shares of McDonalds. Not exactly, but close. You don't go to a grocery store, but rather you call a broker. A brokerage house is your supermarket of stocks. You call up any broker and say, "Charles, I've got 250 dollars, and want to buy as much McDonalds as I can."

You've got the money, you know what stock you want to buy, now what? Do you go to the grocery store and ask for a dozen shares of McDonalds. Not exactly, but close. You don't go to a grocery store, but rather you call a broker. A brokerage house is your supermarket of stocks. You call up any broker and say, "Charles, I've got 250 dollars, and want to buy as much McDonalds as I can."

Now this person goes to the part of the Stock Exchange that is allotted to this particular stock. Here there are companies that specialize in this stock. This means that they will usually, if not always, buy and sell from people at the normal price. The floor broker then buys your ten shares from one of these people, reports his trade through the hundreds of computers on the floor, then reports to his colleagues back at the brokerage house that he bought the stock. The broker keeps a record that you own that stock, rather than sending you the actual paper stock certificates. If you ever want to sell them, your broker will sell them, deduct his commission, and then give you the money.

Now this person goes to the part of the Stock Exchange that is allotted to this particular stock. Here there are companies that specialize in this stock. This means that they will usually, if not always, buy and sell from people at the normal price. The floor broker then buys your ten shares from one of these people, reports his trade through the hundreds of computers on the floor, then reports to his colleagues back at the brokerage house that he bought the stock. The broker keeps a record that you own that stock, rather than sending you the actual paper stock certificates. If you ever want to sell them, your broker will sell them, deduct his commission, and then give you the money.

the company to invest in is no easy job, and there are many different methods people

have come up with to select one. Fundamental analysis is one method, in which

you study the company's current management and position in the market.

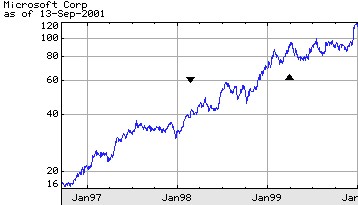

Technical analysis

is another method which is totally based on charts, in which you try to

indentify trends for the

company and invest accordingly. One popular method is just throwing darts at

the stock page, which often beats out all the other methods.

the company to invest in is no easy job, and there are many different methods people

have come up with to select one. Fundamental analysis is one method, in which

you study the company's current management and position in the market.

Technical analysis

is another method which is totally based on charts, in which you try to

indentify trends for the

company and invest accordingly. One popular method is just throwing darts at

the stock page, which often beats out all the other methods.